Insurance is Crucial

As an individual, keeping your insurance policies up to date may not seem like a big deal. For most of us, the biggest hassle is re-signing up for our existing health plan every year, and remembering to print out a new auto insurance card and put it in the glove box.But if you're running a construction company, maintaining insurance is not so simple, yet it is critical to your bottom line. As a general contractor, you are responsible for all of the subcontractors working for you on site. So it's not just your policies which must be up to date, but everyone working for you must have current valid policies as well.

AP Controls Protect You

This is fundamentally important. You cannot have a subcontractor working on your job who does not have current insurance and proof thereof. If, for example, they drive a truck into a ditch and they are not covered, you are financially responsible. And that could make the difference between a profitable job and a loss.

If you're only using Sage to manage insurance, this is not a big deal. But many companies are now using Procore for project controls and management, entering commitments insurance information in that system, not directly in Sage. So now there is a dilemma- which system should control insurance? And if you want accurate information in both, do you just double up your work?

Insurance in Procore

The key is to make sure that the insurance in both systems is up to date without needing to enter it twice. But the two systems do not treat insurance identically. Let's see what that means.In Procore, insurance is managed at the Company level. For the sake of simplicity we are going to refer to these Companies as Vendors, knowing that we mean "Companies which are used for Accounts Payable and which are linked to Sage AP Vendors".

A Procore vendor has insurance policies. You can create new policies at the global level, and you can also create insurance policies for specific projects. For example, if you have a project in Turks and Caicos, and your US policy does not cover you. Or, more practically, if you have projects in different states where policy requirements differ.

In Procore there are not many restrictions on Insurance policies. You can have more than one policy with the exact same type. And right now, commitment and payment approvals are not tied to insurance. But if you're using Procore, you are likely doing so because it is easy to use and get data into the system. You've got people in the field updating things practically in real time, and these same people who are doing submittals, inspections, and drawings are likely also to be the ones with the latest insurance information.

Now let's see how Insurance is set up in Timbeline.

Insurance in Sage

The main difference in the structure of Insurance is that while in Procore you can enter as many insurance policies as you like, in Sage there are only six forms of insurance allowed:- General Liability

- Automobile

- Umbrella

- Worker's

- Custom 1

- Custom 2

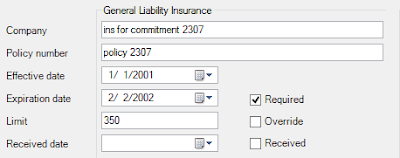

You can only use these six, but you can customize the last two (globally) to be whatever you want. Each type has the following settings:

The data you put on Commitment -level insurance is mostly the same as with vendor insurance, as shown below.

But note these differences:

Vendors have "Require per commitment", which means that each commitment for that vendor must have its own insurance policy set. Vendors have "Proof Required", and Commitments have "Required", each of which means that the insurance policy must be set on the vendor or commitment and in effect in order to pay the vendor in AP. The "Override" setting means allow a vendor to be paid in AP, even if the insurance is not received. You will still get a warning, though.

The "Received" on the commitment is an oddball. It is a check box which effectively means the same thing as the "Received Date" on the commitment and vendor.

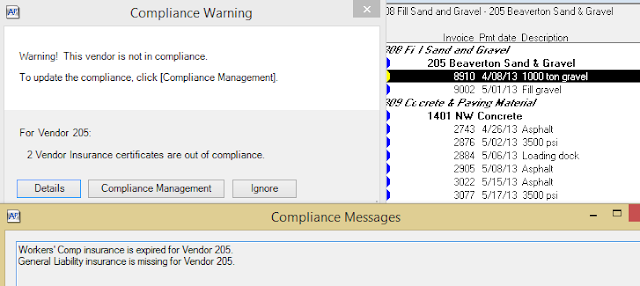

Sage's insurance setup helps to enforce compliance. When your records are up to date then you can be sure that you won't pay vendors unless they are in compliance.

Keeping them in Sync

So how best to keep the two systems in sync? Well, first you need to make sure you understand what it means to be in sync. Both systems have global vendor insurance. But Procore lets you have an unlimited number of policies of any type, while Sage only lets you have 6 policies, 4 of specific types, two you can customize.So at the vendor level, you can sync up to 6 types of insurance between Sage and Procore. But you need to decide on a convention for mapping the types. For example, will your Sage "Worker's" insurance map to one in Procore called "Worker's" or "Workers" or "Workers Comp", or some other variation of "Worker's Compensation Insurance"? And what will you call the two custom insurances, if anything?

Once you've decided how to map the different types for each vendor, then which fields will be mapped? Some are obvious. Sage "Company" maps to Procore "Insurance Provider", just as the Policy numbers easily map as do Limit, Effective Date, and Expiration Date. There is no "Received Date" in Procore, but there is a "Received" check box, like the one on commitments in Sage. But there is no check box for received for Sage vendor insurance, just the received date.

In Sage there is "Required" and "Override", and in Procore there is "Exempt". Should "Exempt" be checked if "Required" is not checked? Or should it be set if "Override" is set?

Now those were the easy decisions! Those were for when you have the same vendor in both systems and you want to map insurance. But how should you deal with project-level insurance in Procore, and commitment-level insurance in Sage?

In Procore, every commitment belongs to one and only one project. But in Sage, a commitment does not have to be associated with a project at all!

|

| Procore commitments must always belong to a Projects. But Sage commitments are associated with projects through their lines. |

Insurance for Sage Commitments

Since commitments always have an AP Vendor, and since that vendor can specify whether insurance is required per vendor, the first thing to ensure is that if there is a vendor in Sage which has "Required per Commitment" checked, then each commitment must also have the same insurance as its parent vendor. But there is no analog in Procore.Insurance for Procore Projects

In Procore, if you have project-level insurance for a vendor, that implies that in Sage, each commitment to that vendor within that project should have the same insurance. This gets tricky because in Sage, a commitment is not tied to any specific project directly. Instead, a commitment has lines, and each line is tied to a project. But there is no requirement that lines on a commitment must be to the same job. You can write a subcontract or PO and have different lines tied to different jobs. Sage does not care. |

| This Sage commitment has two lines written to two different projects, and one line written to none! |

Let's assume the above scenario happens, and in Procore, Vendor 100 has a global auto policy, and a specific auto policy for jobs 03-001. Which policy should be used for this commitment in Sage? Well, there is no good answer, at least no answer that can be automated. Many companies, however, have a policy that each commitment must be tied to one and only one job.